Graduated and Going on to College? Don’t Go Overboard on Student Loans

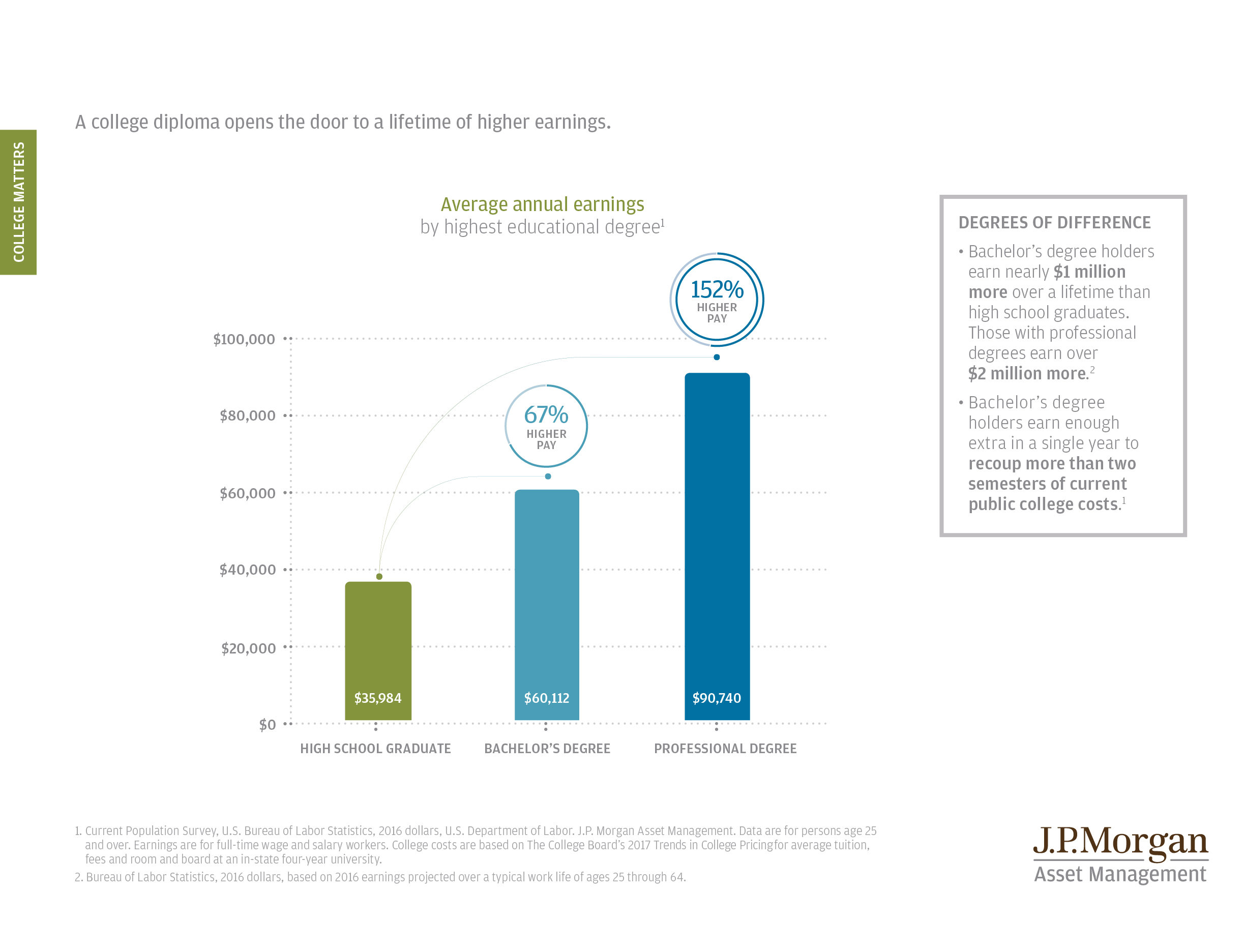

It’s the time of year for high school graduations and many graduates will be continuing their education at university or a college with aspirations of earning a degree. It is rewarding to see your kids grow up and graduate high school and then go on to college. Students in Bellingham don’t have far to go to find an excellent university. Western Washington University is often ranked as a “Best Value” in US News and Kiplinger’s surveys. But, as I wrote in a previous blog post, it can cost upwards of $100,000 for a 4-year degree for one student at full price. I tell my clients to think of those higher education expenses as being an investment in yourself (or in your kids). College graduates typically have much higher earnings potential than those who do not graduate. According to the Education Research & Data Center in Washington State, 62% of high school graduates go on to either a 2 year or 4-year institution and 12 years after graduation, make an average of $55,700 per year, much more than the high school graduate who only makes $21,200. As you can imagine, this extra earned income adds up over a person’s career.

Education is a valuable investment in our youth, and it should be no surprise that many turn to student loans to pay for it. But it has become an epidemic. Bloomberg recently reported that student loan debt climbed from $675 billion in June of 2009 to $1.465 trillion as of the end of last year. For a parent, that debt burden is hard to overcome if you are saving for retirement and making parent PLUS loan payments with 7.6% interest. It is even harder for the students who graduate and must pay off their loans, especially when they start a family of their own and have to pay rent or have a mortgage. Graduating with a bunch of debt is not the future we plan for our young adults.

Making informed choices about student loans

LendEDU published an article where they data-mined a comprehensive financial aid survey and found that as of 2017, the average college/university graduate had over $30,000 in student loan debt, up almost 50% in 10 years. That puts a graduate in an immediate hole right when they enter the workforce. Reading the LendEDU report, Western Washington University graduates fared much better than most, with almost half the national average debt. In the last 10 years, that WWU student debt level has increased, but very little. With tuition going up, it is impressive that WWU has managed to graduate students without having much of an increase in student loans.

If you are about to graduate from high school, or have a kid who is, you can see LendEDU’s report on student loan debt, look up your preferred college or university and see what the average debt burden is upon graduation. If it is high, you may want to dig deeper and evaluate other funding options or whether you can afford the cost of that institution’s tuition and expenses.

High school graduates should make informed decisions about higher education, the degree you pursue, the total cost of that education and the prospects for a good job with sufficient earned income to pay the bills. And, policymakers should make higher education more affordable and more widely available.

Washington State just passed a bill called the Workforce Education Investment Act that guarantees financial aid for more than 110,000 qualified students in Washington to attend college for free or at a discounted rate. Read more about it here. That doesn’t help students with current loans outstanding and it will require higher taxes, but it is a step in the right direction. Our Presidential candidates are also making it a campaign issue. Perhaps we will see Congress do something about this growing crisis soon. The money parents and students are putting towards debt is better spent if it is going back into our economy.

High school graduates have a lot to look forward to upon college graduation in 4 years (more or less), when they will enter the workforce, start their careers and reap the rewards of their investment in higher education. We can unlock that potential by addressing the student loan crisis and making higher education more affordable.

Mark Wallace CFP® AIF® CRPC® is a financial planner at Skyline Advisors, a Registered Investment Advisor providing money management and financial planning services. Skyline Advisors is located at 405 32nd St., Ste 201 in Bellingham and at www.myskylineadvisor.com

Mark can be reached at 360-671-1621 or at .

This article is solely for informational purposes. Advisory services are only offered to clients or prospective clients where Skyline Advisors and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Skyline Advisors unless a client service agreement is in place.